All are backward-looking.įor most small businesses, we recommend none of these three inventory valuation methods. There are three variations on the traditional inventory valuation method for calculating COGS. All types of businesses can use it, not just manufacturers.You have the latest insights at your fingertips and can make decisions much faster.You can then use the latest numbers to conduct scenario planning exercises and to strategically forecast the future.įor service businesses, the Profit Frog approach is a lifesaver, given that they can’t use the inventory method anyway.īenefits of Profit Frog’s COGS accounting approach: Rather than waiting until an accounting period has closed (the inventory method), you can have the very latest COGS data at your fingertips. Input your costs on a regular basis and have a real-time view into COGS, OPEX, profitability, and all the other things that matter.

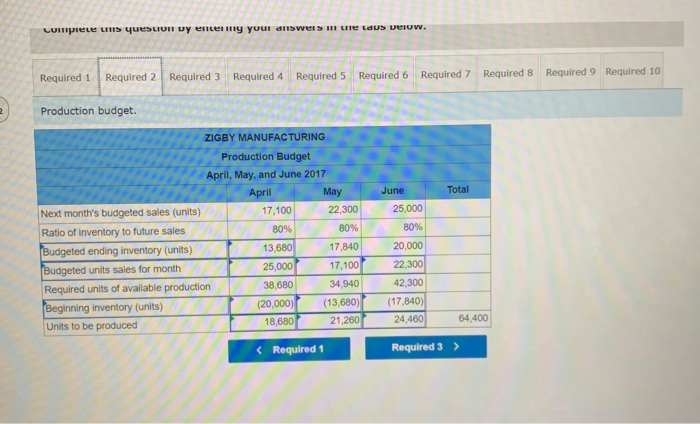

Not applicable to companies that have no inventory, such as SaaS companies and service businesses.Backward-looking and slow: you get insights much later than you need them.Using this method, the company needs to do an inventory count as well as an inventory value calculation for the beginning and end of an accounting period.ĭisadvantages of inventory-based COGS calculations: COGS was derived from calculating inventory turnover during the interval. Determining the cost of goods sold was always based on periodic physical inventory assessments that compare the inventory at the beginning of a period with that at the end of the period. Traditionally, COGS and inventory go hand in hand. For the majority of small businesses, the Profit Frog way is far superior. There’s the traditional COGS accounting method (based on inventory), and then there’s the Profit Frog way.

#ENDING INVENTORY FORMULA WITHOUT COST OF GOODS SOLD HOW TO#

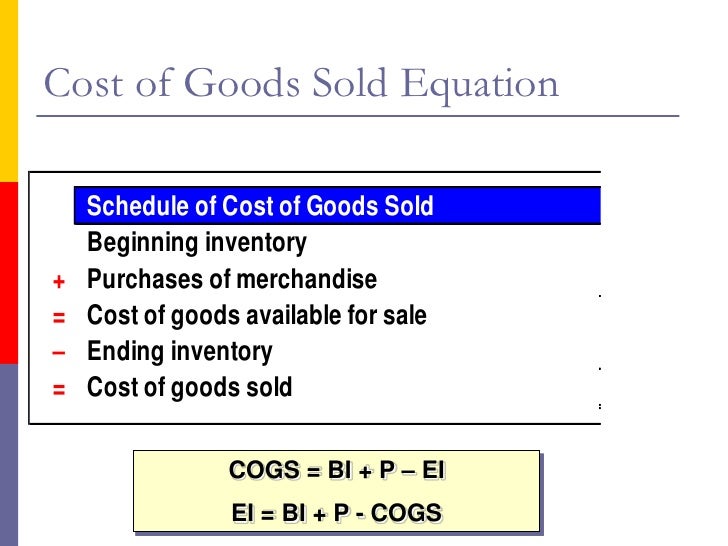

(Yes, service businesses have COGS, too.) How to calculate COGS Our COGS definition includes all direct costs associated with creati ng a product or providing a service. The cost of goods sold definition given by the US Generally Accepted Accounting Principles (GAAP) defines COGS as the cost of inventory items sold during a given period. What is cost of goods sold?Ĭost of goods sold (COGS) is the direct accumulated costs of acquiring or creating products, or of delivering services.

That’s why we’re the leading small business forecasting software. We help you chart the most profitable course, proactively. It’s all about maximizing profitability, no matter what variables the world throws at you. With Profit Frog, you can dynamically plan your company’s future by modeling different scenarios and creating a business plan that grows with you. We walk you through the different business drivers, such as cost of goods sold, sales, and operating costs, and let you put each one in. Profit Frog makes COGS calculations easy with our financial modeling software, which was built specifically for small businesses. Gross profit is calculated by subtracting costs of goods sold from revenue, and its margin is obtained by dividing gross profit by revenue It’s a key component in calculating two crucial business figures- gross profit, and gross profit margin. COGS is reported on your income statement, along with revenue.

0 kommentar(er)

0 kommentar(er)